Many people find starting a business to be appealing, but not everyone understands where to begin. Once you’ve made the decision to start a business, it’s critical that you have a clear understanding of what lies ahead; otherwise, the process may become scary and overwhelming. We, as Web Developers in Orange County, understand how daunting it is to start a business. For this reason, I created this comprehensive guide to help all startup business owners.

Planning, crucial financial decisions, and client market research are all necessary when starting a business. These are only a few instances of the important topics that entrepreneurs must deal with. There is no one strategy that works for everyone when starting a new business, but there are steps you can take to help you define your objectives, create a plan, and eventually launch a successful business.

This 15-step guide will take you through the important stages of starting a business and outline what to anticipate as you set out on your path to business ownership.

1. Analyze your business concept

A “good business concept” is one you can afford to adopt, one that fills a need in the market, and one that has the potential to bring in a substantial profit.

You may assess your business concept using a helpful checklist provided by Princeton Creative Research, which includes the following questions:

- Is there a demand for the business?

- What specific issues or challenges is the business expected to fix?

- Is the anticipated profit sufficient?

- What are the restrictions of the business?

- How easy or difficult will it be to put the concept into practice?

- Is your business ready for the market?

- Are customers able to afford it? Will they purchase it?

- What are your competitors doing in this space?

- Can you be competitive?

- Does your concept actually address a need, or does it need marketing and promotion to create the need?

Product vs. Service-Based Business

People will be able to purchase a product or use a service from your business. Service industries (like law or consulting) sell time and knowledge, whereas product industries mark up product costs and then profit from the difference.

Choose the business type that best fits your personality, abilities, and objectives.

Market Research

You should make sure the possibility is real before pursuing your huge idea. You need actual data. Market research is useful in this situation.

The term “market research” refers to a very straightforward method of obtaining data and feedback to assess the feasibility of your strategy. Is there a market for what you wish to do?

There are numerous approaches to this inquiry:

Conduct Analysis

Trade organizations and websites are a goldmine of knowledge. For instance, the National Association of Home Builders releases quarterly studies on the demand for new construction and renovations in various geographic areas. This would be an excellent resource for someone starting out in the real estate or property industry.

This handy list from the Small Business Administration (SBA) includes more free resources.

Organize Interviews

Make contact with and speak with business owners that operate in the same industry.

Examples of good inquiries are:

How did you assess the initial demand for your product?

What shocked you in the first launch of your business?

What did it cost you to start out?

How long did it take for you to start generating profit?

What would you change if you could start your business again?

Create a Focus Group.

Run your concept by your friends, family, and coworkers in a group setting. How do they feel about it? Would they support the planned business of yours?

Create a Poll

Take a survey of your website’s visitors. Use a survey tool like Google Surveys, ask a question in a Facebook group, or publish a query on Twitter or LinkedIn.

If you’re prepared to put in the time and effort, you can compile a thorough overview of the competitive landscape on your own and you could also engage a market researcher or agency to perform the study for you.

Competitive Analysis

Competitive analysis helps you decide whether your new business can compete with established firms whereas market research informs you of the general circumstances for launching a business (and whether your concept “has legs”).

There is a lot of competition, no doubt about it. In the United States, there are 32.5 million firms, 99.9% of which are small enterprises, according to the SBA’s 2021 Small Business Profile report. Additionally, a huge worldwide market needs to be taken into account if you plan to offer products and services online.

You should follow these methods for your competitive analysis, both locally and online:

Identify your Competitors

Look through the listings on Google and Yelp for nearby businesses that offer comparable goods and services to those you want to offer. To keep track of the changes they make, compile a list of their names, websites, and social media handles.

Examine their Procedures

To determine where you may place yourself within the competitive environment, look at the experience of purchasing their items, the range of their offers, their price, and their reviews.

Look for opportunities.

Convert what you see into strategies for how your new business might satisfy clients’ unmet requirements.

- Is a neighboring competitor the sole business of its sort and charging high prices as a result?

- Could you design stunning branding that offers a more aesthetically attractive experience?

2. Write a business plan

Writing a business plan may seem like a tedious formality, but you should do it for two reasons:

They will probably ask to see your business plan if you plan to apply for outside capital, whether it comes from a bank or an investor.

Making a business plan pushes you to consider your idea seriously and to come up with a plan to get from point A to point Z.

Your concept, the opportunity, the competition, the funding strategy, the customer acquisition strategy, the risks, and the solutions will all be included in your business plan. Although every business plan is unique (because every firm is unique), the majority contain the same fundamental components.

Components of a business plan

| Executive summary | An overview of your strategy. Although you will detail your complete concept later, a two-page introduction establishes the correct tone. |

| Table of contents | List page numbers and section headings for quick reference. |

| Business description | This is the core of your strategy. You will go into detail about what your business will be and how you envision it developing in your description. |

| Market analysis | Determine your target market’s trends, expected growth, and ideal clients. Describe your overall marketing strategy, including any online, digital, social, or other strategies. |

| Industry description | Include data and facts regarding the sector you are focusing on. |

| Business goals | In one year, two years, and five years, where do you envision your business? Describe your plan for getting there. |

| The competition | Analyze any prospective competitors. What is their expected annual sales, how long have they been in business, where are they located, what are their strengths and weaknesses? Describe your strategy for competing with them in your industry. |

| Management team | Your team has to be top-notch since investors frequently claim that they invest as much in the entrepreneur and their team as they do in the business. Here, you provide an explanation of their nature (even if your team is just you to start). |

| Sales forecast | For the first two years, make monthly sales projections. Be reasonable; this estimate has to be supported by data. Start by examining the typical monthly sales of a competitor in a comparable market who is of a comparable size. |

| Financial analysis | For many business owners, the financial element of a business plan is the most challenging—yet crucial—piece. To go along with your realistic strategy, you must provide realistic figures. |

| Action plan | This section will provide explicit instructions for achieving objectives as well as milestones for gauging progress. |

| Appendix | The previous three years’ worth of your income tax returns, a recent credit report, pertinent contracts, information about your partners or employees, and other essential papers should all be included in an appendix. |

3. Obtain funds for your business.

One of the most crucial steps in this process is finding capital for your new business. As a general guideline, you need enough funds to start your business and cover your personal and business expenses for at least six months, as it is a decent amount of time to attract clients, make a sale, and get paid. Your outcomes might vary.

There are several ways to finance your new business. It’s likely that you will raise money for your new small business from a variety of sources, including your personal savings, a possible loan, potential help from friends and family, and possibly some crowdfunding. Prepare to investigate and assemble a variety of funding sources.

Personal sources

You may start looking for money at home. Your own money and resources might serve as the starting point, whether that entails spending your savings or selling certain investments.

Friends and family rank as the second most prevalent source of startup investment. This may be a gift or a loan.

Credit cards, lines of credit, and loans

Without a solid credit history, traditional company loans could be difficult to get. (Note that your business’ credit score is connected to, but distinct from, your personal credit.)

SBA loans, which are given by banks but insured by the SBA, have looser eligibility requirements and are frequently quite doable for start-up companies.

The use of lines of credit and business credit cards is another typical method of financing. When compared to credit cards and lines of credit, which offer continuing access to money up to your credit limit and variable payments based on how much you spend, loans only offer funds in a single sum with a predetermined payment schedule.

Crowdfunding

In order to obtain traditional business financing, you must either take on debt or provide equity. Crowdfunding is distinct.

You advertise your brand or project on a crowdfunding website like IndieGoGo or Kickstarter and invite people to contribute money to it. Then you decide to repay them with a “perk” from your business, with higher benefits for larger investments, rather than paying them back with money or equity.

Let’s take the example of wanting to start a food cart. You might design a crowdfunding campaign in which you promise to name different dishes after your investors. A weeklong dinner honoring one investor is available at $25. They may also receive a free lunch for $50.

Grants

Based on the sort of business you are considering starting or if you belong to historically underrepresented groups in business ownership, there may be options for you to pursue funding.

Here are some sources to take into account:

- The Small Business Administration

- Grants.gov

- Your city or state government. Numerous regional governments provide grants or other incentives to promote the ownership of small businesses. Spending time on this is worthwhile, especially given that there may be less competition for local funds.

Investors

Finding an investor for the business, often known as an “angel,” and is the last alternative. As the name suggests, an angel investor is someone who is prepared to offer financial support to aid in the growth of your business. Typically, this kind of investment entails a portion of the ongoing income as well as ownership shares.

What characteristics do a business have that attract angel investors?

- Is this a reliable prospective business? How do the finances appear?

- Do the team and the entrepreneur have any idea what they are doing? Are they experienced?

- What would be the angel’s potential profit, and when would they get a return on their investment?

4. Analyze business structures

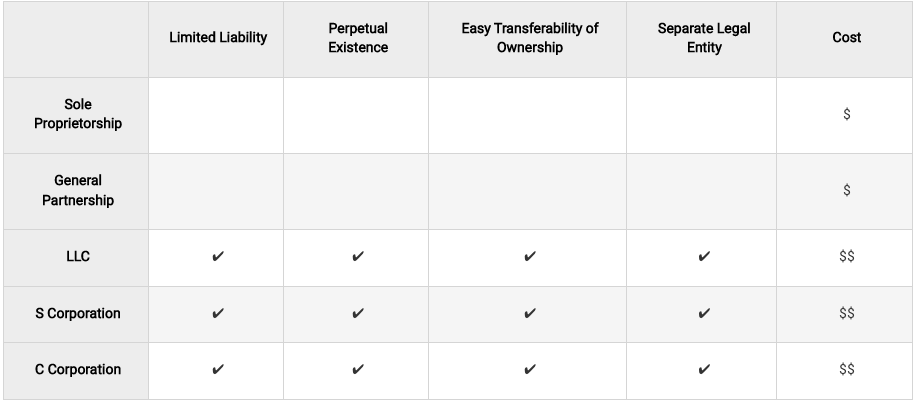

Your business can have any of the four different basic structures:

- Sole proprietorship

- Partnership

- Limited liability company (LLC)

- Corporation

It’s a good idea to consult your accountant and lawyer for guidance when determining which structure is appropriate for your company in order to understand the potential legal and financial repercussions.

Partnerships and sole proprietorships

The majority of small firms begin as sole proprietorships and change to a more complex legal structure as they grow. It is cheapest and simplest to establish a business as a sole owner (also known as a solopreneur, freelancer, independent contractor, or self-employed). The process of establishing a sole proprietorship shouldn’t be expensive or take longer than a few weeks. Similar to a partnership, a collaboration with a friend or business partner is straightforward.

Due to the lack of legal separation between partners and owners, sole proprietorships and partnerships provide less personal financial responsibility protection. You are liable for any damages if something goes wrong with the business, such as when you sell products online and a damaged item is sent to a consumer. As an unincorporated solopreneur, not only is your business at risk, but also your personal assets.

Corporations and LLCs

You can reduce your personal responsibility by incorporating your business. Creditors cannot directly collect money from the owners or shareholders; instead, they may only collect money from the corporation’s assets.

- Limited Liability Companies (LLCs) merge many of the advantages of a corporation and a partnership without the drawbacks. Similar to a corporation, an LLC restricts individual responsibility. An LLC is a distinct legal person that has the power to purchase, sell, and be the subject of lawsuits. An LLC may be simpler to maintain than a partnership. However, unlike a partnership, an LLC is not immediately dissolved by a member’s death, retirement, expulsion, or bankruptcy.

- S Corporations are a popular corporate structure for many small firms since they are designed for smaller enterprises. S Corporations, like LLC, are casual enough to let you manage your business with ease while still offering protection from personal liability. You must submit the required articles of incorporation to your Secretary of State’s office in order to form an S Corporation. After that, you must submit Form 2553 to the IRS. Because creating an S Corporation is a rather complex process, you might want to seek the advice of knowledgeable legal counsel.

- C corporations are typically used by larger businesses. Similar to S Corporations, C Corporations have a distinct tax structure but nevertheless segregate a company’s assets from its shareholders. C companies pay taxes on their profits, and you as an owner or employee also pay taxes on your earned income.

Comparing typical business structures

5. legalize your Business

It’s time to formally launch your business after you’ve decided on a business structure. Remember that each state has different regulations for starting a business, as well as different fees.

File with your local government.

Check the criteria in your city, county, and state for registering your fictitious business name, commonly known as a DBA, if you want to run a sole proprietorship or partnership (doing business as). You may prove you are the company’s owner by registering your DBA name with the relevant authorities. To create a business account at some banking institutions, a DBA is necessary.

Additionally, you will need to obtain the necessary licenses and/or permissions from your city and/or county (such as a business license, a food permit, etc.). To find out the licenses and permits you’ll need, where to acquire them, how much they’ll cost, and where to submit them, contact or go to the business planning office in your city.

Complete an IRS filing to obtain a Tax ID number.

The next thing you need to do is register your company with the federal authorities.

You must ask the IRS for an Employer Identification Number (EIN) if you have established a company, partnership, or LLC. For sole proprietorships without any workers, an EIN is not necessary. However, you might still want to register for an EIN if you have any future expansion plans or if you prefer to keep your personal and business taxes separate.

The IRS offers a checklist online if you’re unsure whether your company requires an EIN. After receiving your response, you can finish the online registration procedure.

The forms you will require at tax time will depend on the organizational structure you have chosen for your business. For additional information about your federal tax responsibilities, visit the IRS website. You can also check the website of your state government.

Consider using a business formation service.

While you have the option of handling the legal business formation procedures on your own, partnering with a third-party service that specializes in the business formation may simplify and occasionally even accelerate the procedure. You may form a legitimate company entity, apply for an EIN, and receive support from organizations like Incfile.

6. Give your business a name

You understand how challenging it might be to come up with the ideal name if you have kids or pets. Selecting the ideal name for your business might be even more difficult because your livelihood may depend on it.

You need a name that is memorable, concise, and simple to spell. More importantly, you must make sure that your company name accurately conveys the essence of your brand. When compared to “Kendrick & Sons,” which might be anything, “Kendrick Family House Painting” is more specific and incorporates an emotional appeal (family). Don’t let a bad name prevent you from taking advantage of this important branding opportunity.

It’s crucial that the name you select is available as a social media handle and an online domain name.

If you can, try to secure the a.com domain. If.com is not available, people are familiar with alternative suffixes like.info or.biz. If any are not available, it is important to know this in advance so you may come up with alternative plans.

The following actions to take in the name game are:

- Think about ideas. Write down all of your potential company names in any order. Flow with your thoughts. Consider using creative language together with more precise descriptions. If you want additional inspiration, you may utilize free online generators.

- Look up the names you like the most online. Your top choices for names could be taken. Ideally, do this early in the process.

- Get opinions. Seek the advice of close family or friends that you trust. Consider how the names sound and make you feel, then write them down and pronounce them aloud.

- Choose the name you like. Do you have a name that keeps coming to mind? Trust your instincts. You’re going to remember this new company’s name for a very long time.

If you have a connection with the name, others probably will as well.

7. Open a business bank account

Open a business bank account whether you are launching a corporation or a solo proprietorship. The benefits are as follows:

- securing your individual savings

- tracking business revenues and spending more easily

- the capability to send and receive payments using business credit cards

- Associates’ ability to access business funds

- improved professional image

Keep your personal and professional funds separate.

Beginning with a clear separation of your personal and corporate funds simplifies accounting and taxes and makes it simpler to assess the financial health of your business.

Additionally, doing so could demonstrate to potential lenders and investors that you are serious about your endeavor and have a solid understanding of business principles.

Opening separate accounts, such as bank and savings accounts, credit cards, lines of credit, and loans, specifically for business usage, is the first step in segregating your funds. Depending on the type of business structure you select, there may or may not be a legal separation between your personal and corporate finances. Recap: Corporations and LLCs provide more liability protection since they are separate legal entities from sole proprietorships and partnerships.

Choosing a Bank

One size does not fit all when choosing a bank. You will have certain demands and goals as a small business owner that set you apart from other businesses. Make sure to complete your analysis and choose a bank based on the criteria that best suits your needs because not all banks will give the same degree of features and perks. Fees, minimum balances, customer service, digital tools, and branch accessibility are a few crucial factors to take into account.

8. Search for a trustworthy accounting and bookkeeping system.

There are several tools and software alternatives available to company owners today that may help them track sales, manage inventory and payroll, and even estimate sales.

But how can you determine which accounting system is appropriate for your business?

To get you started, consider these tips:

Think about your budget.

Software for business accounting comes in a variety of forms, sizes, and price ranges. Some are even available for free or a modest price to download. Generally speaking, the cost of a program increases with its level of specialization.

Analyze your requirements and your accounting knowledge.

You will discover both basic financial software and software created specifically for your industry when you conduct your research. Programs may be created specifically for contractors or restaurants, for instance.

Think about accessibility and functionality

You may access several cloud-based services that let you manage your books from your home or any other location. Some systems have applications that let your staff submit expense reports and track their time. You may interface with your corporate bank accounts with some as well.

Consult your accountant.

At tax time, even if you manage the accounts yourself, you might still want to hire an accountant. Additionally, it is smart to examine programs that are compatible with their tax software by asking the same specialist for their recommendation on company accounting systems. There are several reliable solutions for accounting software. FreshBooks, QuickBooks, and Zoho are a few to take into account.

9. Take professional insurance into account

Insurance is yet more means of securing your business. The following are typical coverage kinds to take into account and go through with your broker:

- Health: You must get health insurance, whether it is via COBRA, Healthcare.gov, or your own broker.

- Property: This includes lost or damaged business equipment and materials.

- Comprehensive general liability (CGL): This insurance serves two purposes. It first protects you from injuries suffered by visitors of your business. Second, CGL will pay for your defense if you are sued.

- Business interruption insurance: This protects against losses resulting from the incapacity to undertake operations due to a fire, flood, disaster, etc.

- Malpractice: This is a defense used by experts like physicians and attorneys to offset losses brought on by poor performance. Insurance for mistakes and omissions and product liability may also be included.

- Workers’ compensation: If you employ people, you must have workman’s compensation insurance to cover accidents at the workplace.

- Disability: When you are unable to work due to an injury, disability insurance pays for your lost wages.

10. Keep your intellectual property safe.

Small business owners increasingly produce intellectual property that has to be secured, especially in today’s content-centric internet environment. Examples include blog posts, products, website names, trademarks, etc. Tools for defending those consist of:

- A non-disclosure agreement (NDA): You may occasionally need to disclose private information to another person. If so, ask them to sign an NDA, which effectively states that neither party may use or disclose the information you will be exchanged without first receiving your express, written approval.

- Copyright: Written expressions in physical forms, such as web content, photos, and manuscripts, are protected by copyright law. The only and exclusive right to use or reproduce your work is granted to you by copyright. Although it is not necessary, the ideal approach to establishing copyright is to file a registration with the United States Copyright Office and then accompany the work with the copyright sign (©).

- A trademark is a slogan (“Just Do It”), a name (such as “Nike”), or a symbol (such as “The Swoosh”) that identifies a company or brand as distinctive. You can utilize a registered trademark (®) by registering it with the United States Patent and Trademark Office (USPTO).

- Patent: A patent safeguards an invention. A patent must be requested through the USPTO and then be in the “patent pending” state. Be aware that obtaining a patent certainly involves legal assistance, unlike obtaining a copyright or trademark.

11. Form a group of reliable experts

Even seasoned business owners occasionally require professional counsel, particularly in the areas of law and finance. Lawyers may assist with a variety of legal concerns, including contracts, leases, employee hiring, and firing, among others. Accountants and tax professionals may assist with tax preparation and provide other valuable financial counsel.

The ideal method to locate that knowledgeable adviser is from a satisfied client. A few advertisements won’t reveal as much about a professional as a good recommendation will.

Other solutions if you can’t receive a referral include:

- Local bar organization: Your local bar can suggest you to reputable business attorneys. Nearly all cities have a group of neighborhood lawyers known as a “bar association.”

- AICPA: The leading national organization for CPAs in the United States is called the American Institute of Certified Public Accountants (AICPA).

- LinkedIn: LinkedIn is a social network for networking with other professionals. Use it to establish connections with local candidates for your legal and financial support team.

12. Select your payment methods.

Customers may pay you in a variety of methods nowadays, including cash, cheques, debit cards, credit cards, Apple Pay, Google Pay, Zelle, and PayPal. Accepting as many of these payment methods as you can help your consumers feel more at ease when they wish to send you money.

13. Promote and market your business

Get the word out about your big venture before you open your physical or virtual doors. The majority of your potential consumers or customers are online.

The following actions can be taken to inform them that you are open for business:

Establish a corporate website.

A user-friendly and helpful website will pay for itself whether you build it yourself using a platform like Shopify or Wix or hire someone to do it for you. Given that more than half of all web searches are now made on smartphones and other mobile devices, it is critical that your website be mobile-friendly. To save money and time by avoiding hassles to ensure that your website is mobile-friendly, we recommend for every start-up business owner hire a web designer in Orange County.

If you’re searching for a competent web designer in Orange County, we’d be delighted to help. Orange Web Group is a well-established company that offers various services for digital marketing in Orange County, CA.”

Search engine optimization (SEO)

It makes sense to invest in search engine optimization, or SEO, as the majority of consumers start their search for a good or service using a search engine like Google or Bing. In order for potential clients to find you, SEO involves having your website featured in search results and indexed by search engines.

If you do the following, your website is more likely to get found and come up higher in search results:

- Make dedicated pages devoted to important business topics.

- Put keywords in your tags and content for those pages.

- Utilize a quality SEO plugin to examine your data.

As a web designer in Orange County, I understand how tedious it is to do those things manually, especially for a beginner but keep in mind that you can always ask for help by joining a support group focusing on SEO. In addition to this, some web developers in Orange County also provide this service which is included in their package or can be purchased separately.

Pay-per-click

Fortunately, you don’t need to be an expert in SEO to score well in search results. You may purchase an advertisement on Page 1 as well as ad space on other websites with pay-per-click advertising.

Social media campaigns

One of the most crucial platforms for connecting with the world is social media, where having a strong presence has equaled the importance of having a website. Focus on establishing a presence on the platforms that your target audience uses the most. If they use Instagram, you must use Instagram as well. Web Developers in Orange County always highlight the importance of websites and social media. If these two work well, there is a big possibility that your business will eventually succeed.

14. Hire your first worker

If you ever want to scale your business or grow, you will need help. And that begins with hiring your first employee. Here’s how:

- Organize: Sit down and make a list of common tasks. Decide which must be done by you (client acquisition for instance) and which can and should be done by someone else (administrative tasks). This list will form the foundation of the job description.

- Cast a broad net: Inform your contacts that you are seeking for new staff. Post the job description on several employment boards, such as Indeed, Monster, Craigslist, and others. Even word of mouth from relatives and friends can be effective.

- Interview: Find applicants with the required qualifications and background, and spend time getting to know them.

- Hire: Ask your lawyer to prepare a contract for employment.

- Make it legal: You and your new employee must file a number of paperwork, including a W-4, tax withholdings, a Form I-9, and others. For specifics, speak with your attorney.

15. Track and modify business objectives for growth

Data from the Bureau of Labor Statistics show that over 20% of small firms in the United States fail during the first year. By the conclusion of the second year, that percentage increases to 30%.

That therefore also means that 80% of new enterprises thrive in their first year and that 70% are still operating after two years.

However, it raises the following question: What distinguishes success from failure?

Flexibility is a key component of the solution. Successful business entrepreneurs keep a close eye on their objectives and make any required growth adjustments.

Any business that made it through the pandemic shutdowns is aware of how quickly the current market environment may shift. Your company needs to be adaptable enough to deal with these changes.

Here are some general guidelines for establishing objectives, keeping track of them, and striving to achieve them.

- For setting company goals, use the SMART goals. Your strategies should be specific, measurable, achievable, relevant, and time-based. Making consistent progress toward short-term objectives helps build momentum that will assist your business in achieving long-term objectives.

- Analyze your progress. By carrying out routine evaluations, you can gauge the performance of your business. Whether you have one employee or fifty, review feedback from each and consider strategies to keep on track by collaborating on overall objectives.

- Goals may need to be modified or adjusted. Your objectives, business strategy, or timeframe may need to be modified as your company expands or the market changes. Consider these changes as possibilities rather than failures.

FAQ for starting a business

Can I start a business without any capital?

The simple answer is yes, but you’ll need to be resourceful and put in a lot of effort if you want to launch a business on a tight budget. You must find a way to make up the money you lack, which typically entails using your imagination and hard effort.

It also implies that you shouldn’t quit your day job since you’ll need the money from it while you try to raise the capital for your new business and, later, as you try to turn a profit. Prior to starting a new business full-time, experts advise saving at least six months’ worth of costs.

Here are some recommendations for starting a business on a tight budget:

- Create that great concept. Your task is to expand on that “aha!” moment because people will invest in a successful concept. Consider the following:

- What is the issue I’m trying to resolve, and how can I do it most effectively? (People will pay you to fix their issues.)

- What are other companies doing to address this issue, and how can I incorporate their strategies into my own business?

- What tools and skill sets do I need to do this?

- What tools and skill sets do I need to learn?

- “Sell” your concept to loved ones, close friends, and coworkers. Use the extensive fundraising possibilities of crowdfunding websites like Indiegogo, SeedInvest, and Kickstarter in addition to one-on-one discussions and brief meetings with prospective investors.

- Find out about small business loans and grants. Check out these links for further information:

- Grants.gov is a database of grants managed by American government organizations.

- The Economic Development Administration’s national directory, EDA.gov, will assist you in locating grants that are offered in your state or neighborhood.

- Small Business Development Centers help in connecting entrepreneurs with funding options and other types of support.

- SBA.gov contains a list of small business funding programs.

- Connect with other company owners and entrepreneurs. To connect with other like-minded professionals, join regional business and professional groups (both online and offline). Find out how they raised money for their company. Think about collaborating with a SCORE volunteer mentor.

- Use “Shoestring Marketing”: There are a variety of low-cost options to spread the word about your new company, including websites, social media, pay-per-click advertising, e-newsletters, and more.

What kind of business is ideal for a newbie to start?

The secret for a newbie business owner is to start a company that is focused on a set of skills you already have. What do you excel at? How do you make that ability, skill, or pastime into a successful business?

Choosing a business that requires low initial expenditure in terms of overhead or inventory is another criterion for a seamless start-up. Here are a few suggestions for companies you can start and grow as you gain knowledge and success.

- E-commerce

- Pet sitting and walking

- elder or child care

- gardening and landscaping

- Create and market handcrafted products on platforms like Etsy

- Handyman services

- Virtual assistant services

When is the ideal period to start a business?

There is a proverb in Japanese:

Twenty years ago was the ideal moment to plant a tree. Today is the second-best time.

As with many other important decisions in life, there may never be the ideal moment to start a business, but sometimes you simply have to act when it seems right. You may completely miss the window of opportunity if you wait until you have everything else in your life in order. Keep in mind that you can start your business as a side project while you are still employed at another position.

The nature of your business may also affect the ideal timing to start, in addition to your own personal objectives. For instance, if you own an ice cream store or offer a snow removal service, you’ll need to start planning at least three months in advance of your peak season. There are typically two suggested launch periods for non-seasonal businesses: January and the spring. The beginning of a new fiscal year in January might make bookkeeping easier. Beginning in the new year also gets you ready for the spring, when travel is brisk and the weather is pleasant.

Hire Top-notch Web Developers in Orange County for your Startup Business

Looking for high-quality web development services? Orange Web Group’s leading team of Web Developers in Orange County is here to help. We have you covered whether you need assistance with a few web projects each month or you need a full team of developers who can work directly in your systems.

Save money and time by avoiding hassles. Hire the best Web Developers in Orange County today. For the time being, we are providing complimentary consultations to local business owners. Contact us and we will work with you to create the most visually appealing version of your website.